8915-e tax form release date

TurboTax has an available date of March 24 2022. Health Coverage Tax Credit.

Form 8915 E For Retirement Plans H R Block

You may be able to enter information on forms before saving or printing.

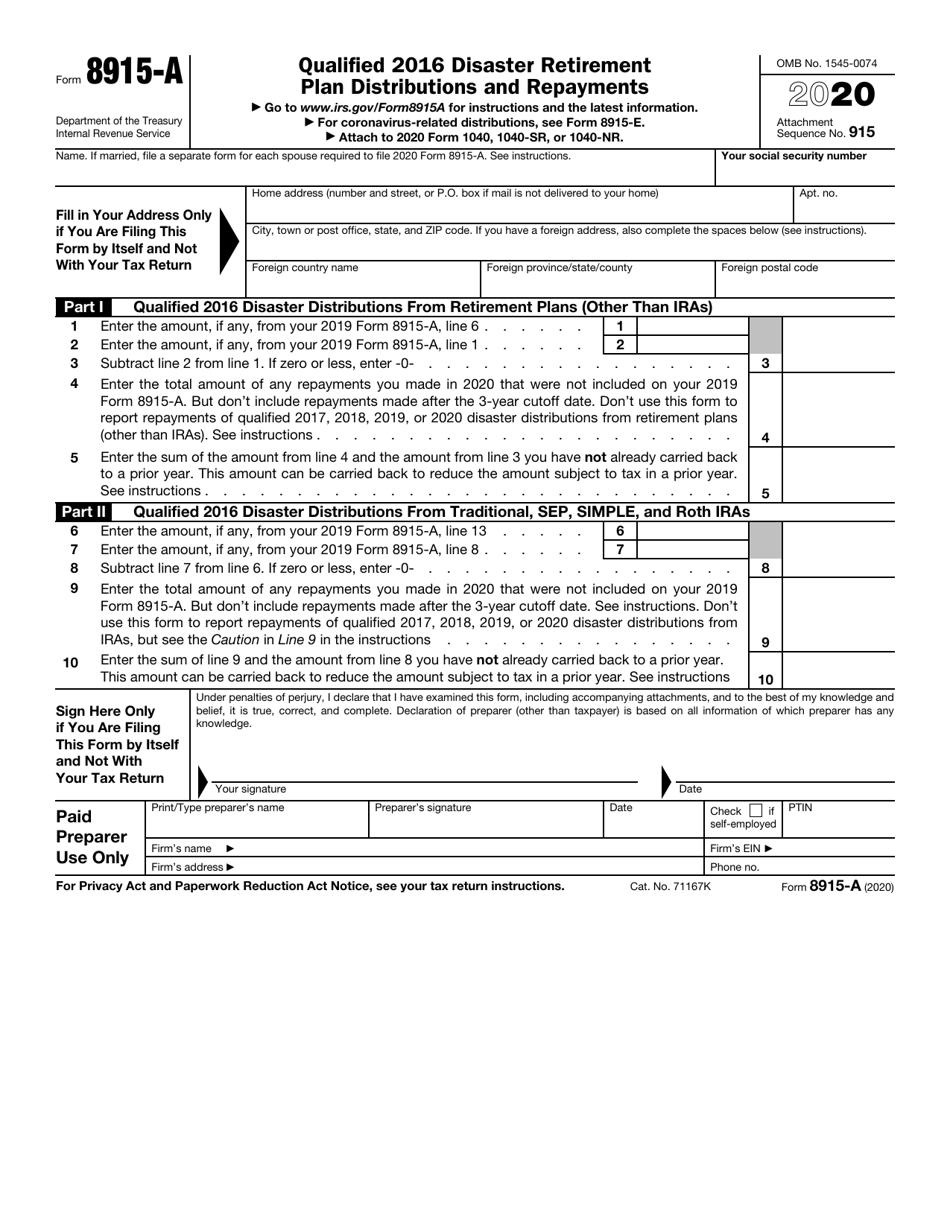

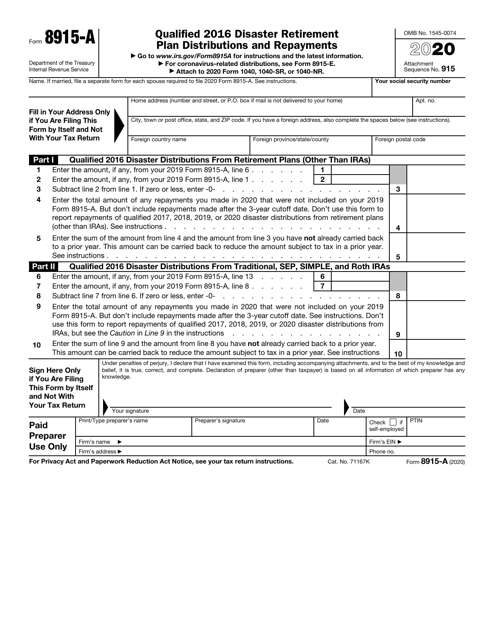

. Traditional sep simple or roth. I documented it here. Attach to 2020 Form 1040 1040-SR or 1040-NR.

If you think you qualify for a qualified disaster distribution and need help completing the 8915-E tax form get help. State programs are 3995 each state e-file available for 1995. Allocation of Refund Including Savings Bond Purchases Form 8889.

See Coronavirus-related distributions under Qualified 2020 Disaster Distribution Requirements later. Select a category column heading in the drop down. When Will 8915 E Be Available Turbotax 2022 Mar Find.

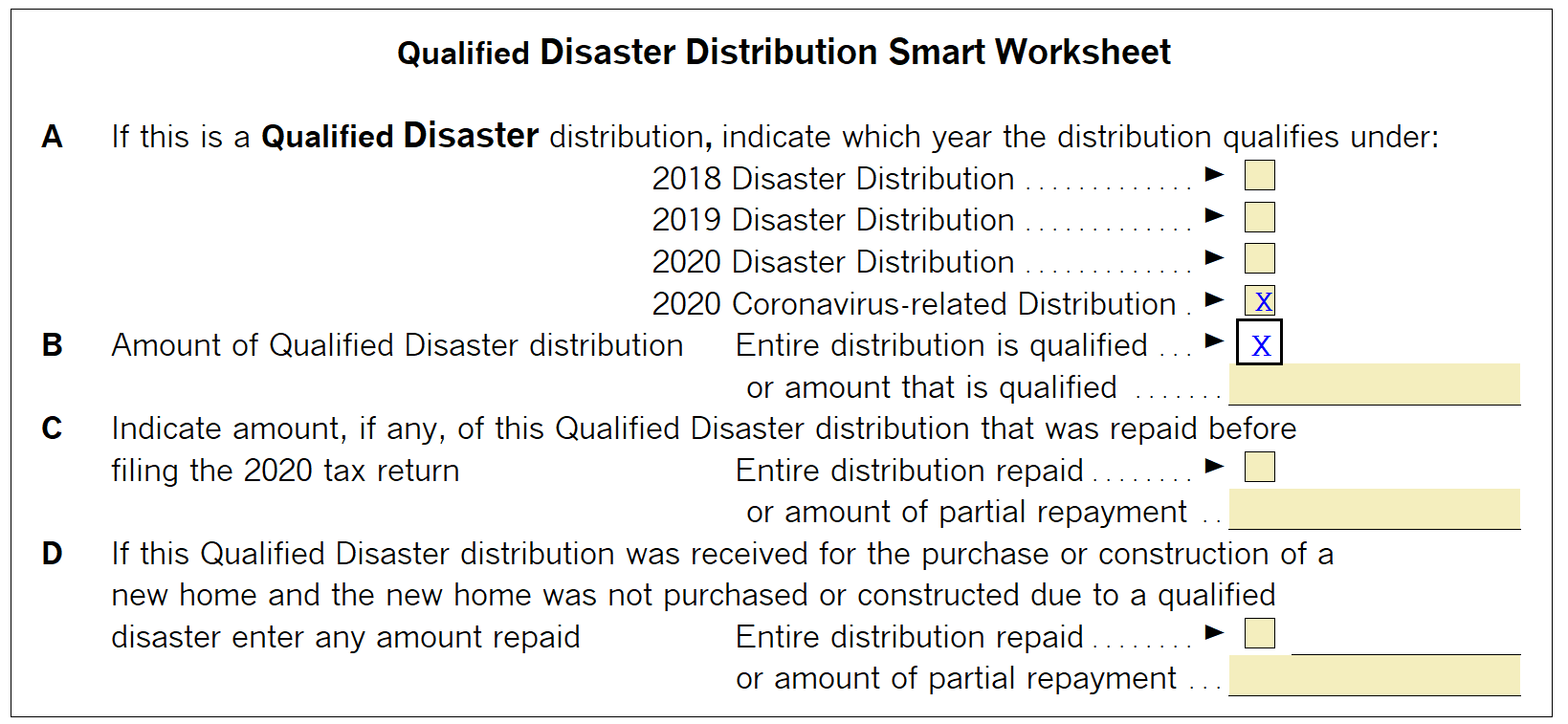

Health Savings Accounts HSAs Form 8936. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E. Do not use a Form 8915-F to report qualified 2020 disaster distributions made in 2020 or qualified distributions received in 2020 for 2020 disasters.

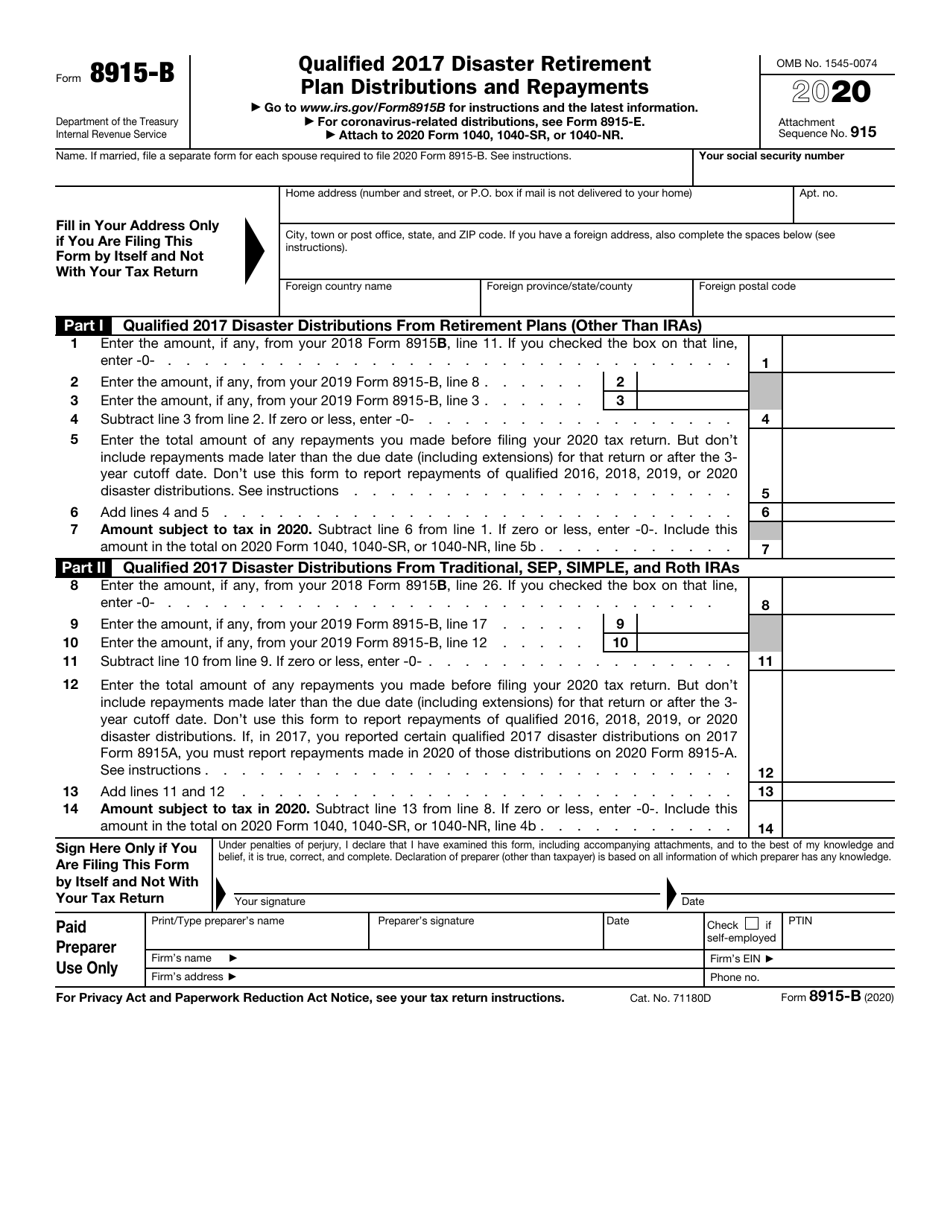

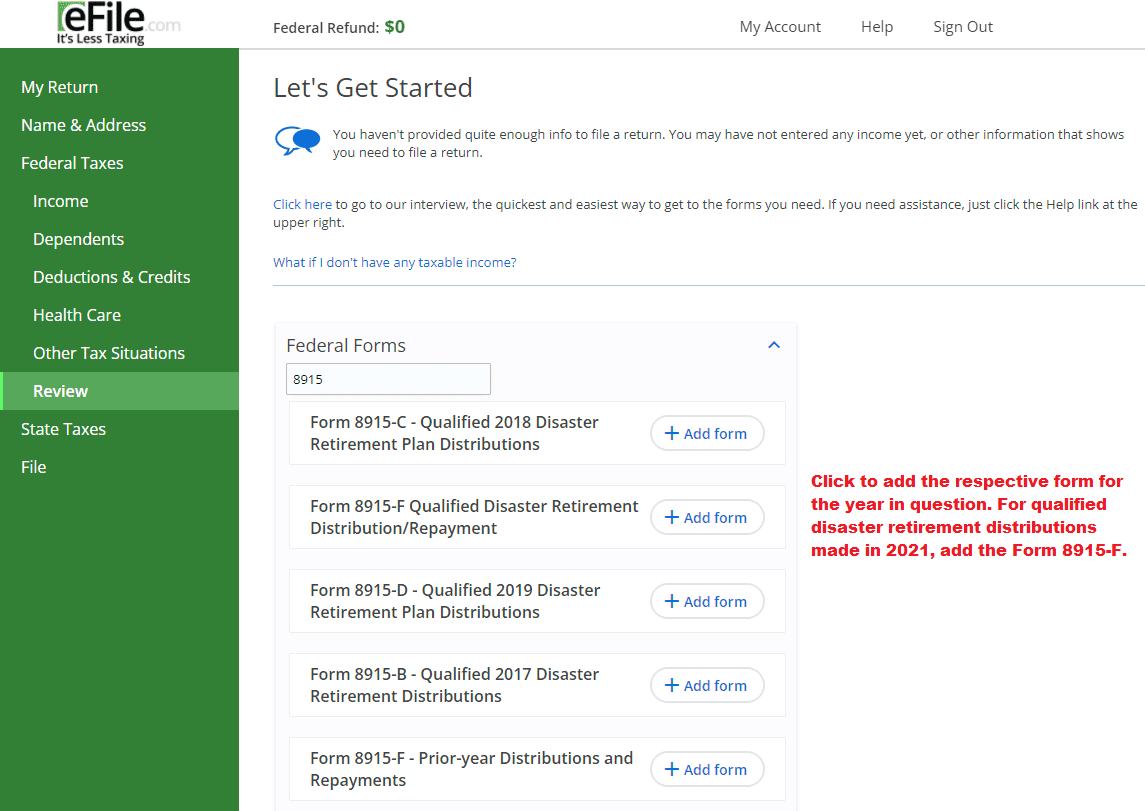

Qualified 2017 Disaster Retirement Plan Distributions and Repayments 2021 02032022 Inst 8915-B. Click Taxpayer Qualified 2020 disaster retirement plan distributions and repayments Form 8915-E. Form 8915-e Release Date Turbotax.

See Coronavirus-related distributions under Qualified 2020 Disaster Distribution Requirements later. A crd is a distribution taken by a qualified individual from january 1 2020 through to december 30 2020 from an ira or employer plan such as a 401 k. For Tax Year 2021 and later you will no longer use.

Click Retirement Plan Income in the Federal Quick Q. Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Taxpayer Final on 02252021 EF on 02252021 Form 8915-E Qualified 2020 Disaster Retirement Plan Distributions and Repayments Spouse. The Form 8915-E 2020 Disasters is replaced with -F forever form for tax year 2021 filing.

You will create this form 8915-F in the program under the. 8915-e tax form release date Saturday March 5 2022 Edit If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E. This form will be used for anyone who chose to take a distribution from their retirement and spread the taxable amount over three years.

Enter a term in the Find Box. It was recently approximately 10 days taken out of draft and finalized. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions eligible for special tax benefits on Form 8915-E.

Click on column heading to sort the list. The 8915-E is available in the TY20 program only. Your social security number.

Since your browser does not support JavaScript you must press the Resume button once to proceed. State e-file not available in NH. A distribution made December 31.

You will still use 2020 Form 8915-E to report coronavirus-related and other qualified disaster distributions. On your 2020 Form 8915-E you reported a coronavirus-related distribution of 9000 made to you from your traditional IRA on April 14 2020. This form replaces Form 8915-E for tax years beginning after 2020.

If married file a separate form for each spouse required to file 2020 Form 8915-E. Please be aware that these instructions are only if you previously filed the 8915-E on your 2020 return. Made or received in 2020.

From within your TaxAct return Online or Desktop click FederalOn smaller devices click in the upper left-hand corner then click Federal. Credit for Qualified Retirement Savings Contributions. This is exceedingly disappointing to have a release date of 3312022 when the update came from the IRS on 2112022.

Back to your 2020 Form 8915-E if you filed 2020 Form 8915-E and are eligible to amend your 2020 return. Use Form 8915-E if you were adversely affected by a qualified 2020 disaster or impacted by the coronavirus and you received a distribution that qualifies for favorable tax treatment. February 12 2022 by Red Redial Team.

Qualified Plug-in Electric Drive Motor Vehicle Credit. IRS Issues Form 8915-E for Reporting Qualified 2020 Disaster Distributions and Repayments Provides 2020 Forms for Earlier Disasters EBIA March 17 2021. By - September 6 2021.

E-file fees do not apply to NY state returns. Revision Date Posted Date. The 8915-F is scheduled for release on 33122.

Instructions for Form 8915B Qualified 2017 Disaster Retirement Plan Distributions and Repayments. Most personal state programs available in January. When will form 8915-E be update and available for 2021 tax year.

Click on the product number in each row to viewdownload. Release dates vary by state. The following research on When Will 8915 E Be Available Turbotax 2022 will inform you about the benefits of filling out this form.

Thanks for your idea. To enter or review Form 8915-E information. Instructions for Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments 0222 0215.

Fill in Your Address Only if You Are Filing This Form by Itself and Not With Your Tax Return. The IRS created new Form 8915-F to replace Form 8915-E. If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year.

We have all had to make sacrifices in one way or another to accommodate getting things done on time in spite of COVID-19.

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

Solved Form 8915 E Is Available Today From Irs When Will Page 2

Irs Form 8915 A Download Fillable Pdf Or Fill Online Qualified 2016 Disaster Retirement Plan Distributions And Repayments 2020 Templateroller

Retirement Tax Services Form 8915 E If Your Clients Had 2020 Taxable Distributions Learn Asap Meta Http Equiv Content Security Policy Content Script Src None

Solved Irs Form 8915 E Page 2 Intuit Accountants Community

Irs Form 8915 B Download Fillable Pdf Or Fill Online Qualified 2017 Disaster Retirement Plan Distributions And Repayments 2020 Templateroller

Irs Form 8915 A Download Fillable Pdf Or Fill Online Qualified 2016 Disaster Retirement Plan Distributions And Repayments 2020 Templateroller

When Will 8915 E Be Available Turbotax 2022 Mar Find

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

Generating Form 8915 In Proseries

Taxes On Cares Act Ira Withdrawals Form 8915 E Youtube

Solved Form 8915 E Is Available Today From Irs When Will Page 2

2020 2022 Form Irs 8915 D Fill Online Printable Fillable Blank Pdffiller

Coronavirus Related Distributions Via Form 8915

When Will Form 8915 E 2020 Be Available In Turbo T Page 19

8915 F 2020 Coronavirus Distributions For 2021 Tax Returns Youtube